How to Reduce Risk During Market Volatility

Market volatility is inevitable in property investing, but it doesn't have to derail your wealth-building plans. Most successful...

At Investors Choice Mortgages we believe that First homebuyers have the opportunity to be the wealthiest generation of property owners that our country has ever seen.

Affordability is obviously an issue and it means first homebuyers must consider their first property purchase through a different set of eyes than their parents or those before them. The reality is that most first home buyers will not be living in their first home in 20 years as their grandparents did. In fact we believe that first homebuyers will not be living in their first property within three to five years of the purchase.

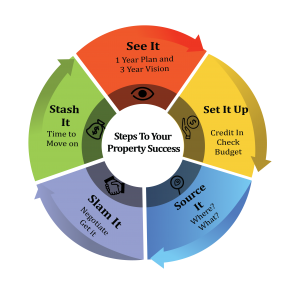

If this sounds like you then you are not really a first home buyer you are a first property buyer and this is where the opportunity for your to realign your thinking and start thinking strategically about this purchase will allow you to really create a wealth foundation for you and your family.

With this in mind here at Investors Choice Mortgages we are here to support you in a number of ways:

You need to start thinking like an investor – you need to know how an investor assesses property for its wealth potential and how to select the right property. On one hand you are a little different to most investors because you have an extra dimension to consider – convenience. Although there are over 15,575 suburbs and towns within Australia, based on your work and family commitments you are usually limited to about 20-40 suburbs for your initial research – depending on where you are willing live.

However to truly make your first property purchase work you’ll need to know how to research those suburbs and compare them. You’ll need to know exactly what you can afford as a maximum purchase price.

You’ll also need a flexible loan so that it can change as your needs change- so if you decide to upgrade and move you can turn the well-bought property in an in-demand area into an investment property. Many first homebuyers make this mistake and it ultimately prevents them from turning their property into an investment. They start with a homeowners loan, like their parents did. This means is that they often have prevented many of the tax benefits that a finance lending structure built purposefully for their flexibility and specific circumstances would allow.

Read the process of a first home owner below and learn how Investors Choice Mortgages can assist you.

The Gold First Home Buyers Service was designed in particular for first homebuyers. It will provide, not only the loan structure to suit your first purchase, but also offers online education through a 7 module course that will take you from those 20+ suburbs down to the three to five that will really allow you to start creating your wealth with this first purchase.

In addition, the Investors Choice Mortgages members section will give you access to many tools, resources and assistance including an initial Strategy Call once we have your borrowing capacity determined.

All in all the Gold First Home Buyers Mortgage Service gives you the helping hand you need to make this first purchase truly the cornerstone of your future wealth.

If you are still confused about how your home can start creating your wealth, we’ve put together a 7 part video series, perfect for first home buyers. Originally created for Australian Women’s Weekly readers, this series is seriously packed full of valuable info. Sign up and receive 7 short 8-15 min videos that will take you step by step through the many ways that you can start making your home work for you. You may also find our FAQ’s for First Home Buyers useful.

Market volatility is inevitable in property investing, but it doesn't have to derail your wealth-building plans. Most successful...

Economic uncertainty creates a unique paradox: while most investors freeze in fear, educated investors often find their greatest opportunities....