How to Reduce Risk During Market Volatility

Market volatility is inevitable in property investing, but it doesn't have to derail your wealth-building plans. Most successful...

read more >

The reality is that today most first home buyers are not purchasing a home that will be their home forever. In most cases your first home is just a stepping stone into the property market. If purchased correctly it could be the foundation to your future wealth.

It makes sense then, to find the right property and set up the right finance structure so you can take your first step towards achieving your long-term goals confidently and with all the flexibility that you need.

However next time around you want to be more savvy concerning where and how you buy your next home. As well as assistance in financing your next home purchase, you would also like guidance on how and where you should buy so you can make your home - your biggest asset - really work for you.

There are so many confusing messages when starting out. Should you look at positive cashflow or capital growth or can you have both? Should you buy regionally or around the corner so you can keep an eye on the property? These questions – and many more – is what every investor grapples with when they start buying. At Investors Choice Mortgages we offer you a process that can assist you in your considerations.

Let’s face it – if you have more than one investment property this puts you in a rare group of just 10% of all Australians.

You may have struggled with the capital growth versus passive income argument and considered commercial property as the next step. So now what?

Whether you are refinancing for a better product or interest rate, to consolidate debt or even to access equity to make another purchase or complete a renovation - whatever the reason - at Investors Choice Mortgages we will look at your current lender and look at if refinancing to another lender is even necessary.

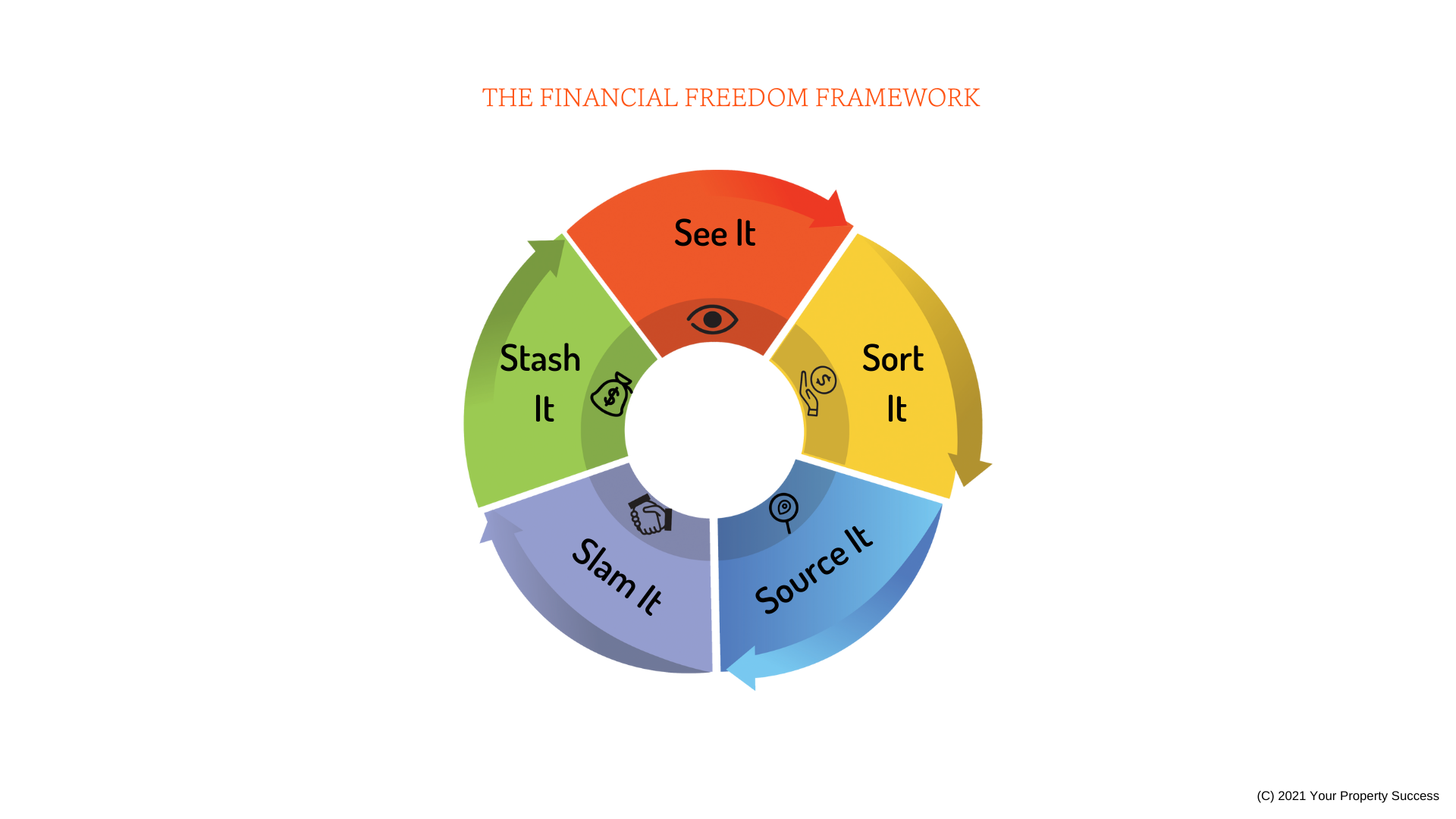

Investors Choice Mortgages is the only mortgage broker which integrates the Financial Freedom Framework for savvy property buyers.

This is why Investors Choice Mortgages is more than mortgages.

Not only do we help you do all the lending, but we also walk you through the entire journey of purchasing a property and beyond.

This gives you the confidence that your purchase is part of your overall plan to achieve your property success.

We work with you every step of the way, supporting you with your property purchase.

Jane Slack-Smith Director

P.S. Do you want to learn more about the Financial Freedom Framework? Watch this video.

Donate

Donate

Kids Helpline is Australia’s only free, private and confidential 24/7 phone and online counselling service for young people aged 5 to 25.

Since 1991, Australia’s kids and young people have been turning to our professional, specialised counsellors, no matter who they are, where they live or what they want to talk about.

Over this time, we have responded to over 8 million contacts. For some young people, connecting with Kids Helpline has been a life-saving experience, while for others it’s about practical help and emotional support at the critical moment they need someone to listen.

Market volatility is inevitable in property investing, but it doesn't have to derail your wealth-building plans. Most successful...

read more >Economic uncertainty creates a unique paradox: while most investors freeze in fear, educated investors often find their greatest opportunities....

read more >Interest rates are the invisible hand that shapes every property investment decision you make. Whether you're building your first...

read more >